By using these standardised formats, businesses can ensure consistency in their documents and streamline the creation process. A fiscal year is an accounting year that ends on a date other than December 31. For example, a school district might have a fiscal year of July 1, 2023 through June 30, 2024. A retailer might have a fiscal year consisting of the 52 or 53 weeks ending on the Saturday nearest to the first day of February. To see a more comprehensive example, we suggest an Internet search for a publicly-traded corporation’s Form 10-K.

Gross Profit:

These numbers show changes in equity that don’t come from the owners, giving a full view of the company’s finances over time. By analyzing both traditional net income and the broader comprehensive income, financial experts get a full picture of a company’s performance. Paying attention to unrealized gains and losses gives insight into future financial challenges and chances not shown by net income alone.

#3 – Available for Sale Securities

The comprehensive income statement offers invaluable insights into the financial health and performance of a company, highlighting the impact of market and statement of comprehensive income economic conditions on its assets and liabilities. For stakeholders, including investors, analysts, and creditors, this statement is essential for making informed decisions, as it provides a complete picture of the financial dynamics affecting the company’s equity. The income statement, also known as the statement of earnings or P&L, plays a big role in financial reporting. It shows a company’s revenues and expenses over a certain time, making it easy to see how well the business is doing. This category includes income or expenses that are not directly related to the core operations of the business. It typically includes items such as interest income, interest expense, gains or losses from the sale of assets, and other non-operating activities.

- To guarantee that their financial statements meet the criteria of both IFRS and US GAAP, companies who operate under both standards may need to make modifications.

- A positive balance in this report will increase shareholders’ equity, while a negative balance will reduce it; the change appears in the accumulated other comprehensive income account.

- Since most small businesses operate under constrained budgets and fixed resources, proper accounting is vital in providing crucial information to facilitate your business’s growth and development.

- In conclusion, the statement of comprehensive income provides important information about the financial performance and health of a business.

- A dedicated statement of comprehensive income offers a clear and distinct presentation, separating it from the traditional income statement.

The Statement of Comprehensive Income Explained

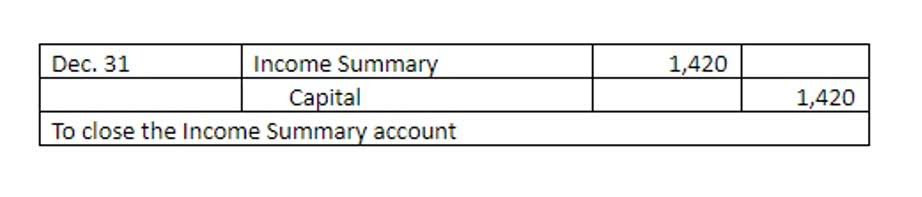

It is the mathematical result of revenues and gains minus the cost of goods sold and all expenses and losses (including income tax expense if the company is a regular corporation) provided the result is a positive amount. If the net amount is a negative amount, it is referred to as a net loss. When a financial statement reports the amounts for the current year and for one or two additional years, the financial statement is referred to as a comparative financial statement.

Revenue

- Net income, often referred to as the “bottom line,” represents the profit or loss a company has earned over a specific period, excluding any items that are not part of its core operations.

- The statement can show the earning per share and how the net profits are distributed according to the outstanding shares.

- It is the mathematical result of revenues and gains minus the cost of goods sold and all expenses and losses (including income tax expense if the company is a regular corporation) provided the result is a positive amount.

- Further details of the Foundation’s Marks are available from the Foundation on request.

- Even though the income statement is a standard tool for measuring a company’s financial health, it falls short in key areas.

- These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license.

It includes items such as sales revenue, cost of goods sold, operating expenses, interest income, and taxes. The statement of cash flows (or cash flow statement) is one of the main financial statements (along with the income statement and balance sheet). The balance sheet, which is also known as the statement of financial position, reports a corporation’s assets, liabilities, and stockholders’ equity account balances as of a point in time. The point in time is often the final instant or moment of the accounting period. Hence it is common for a balance sheet to report a corporation’s amounts as of the final instant of December 31.

Financial Data

- It includes all items that bypass the net income calculation, such as unrealized gains and losses on investments, foreign currency translation adjustments, and pension-related changes.

- Understanding this statement is crucial as it provides a more holistic view of an organization’s financial performance over a period.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- For the first nine months of 2024, Ford reported comprehensive income of roughly $4.11 billion, the majority of which was attributable to the company.

- Financial statements must be prepared quarterly and annually for publicly traded corporations, but small businesses are not subject to the same reporting requirements.

It will provide you with all of the end-of-period numbers you’ll need to make an income statement. It also emphasises both current and accumulated expenditures, which are expenses that the firm has yet to pay. However, if a company’s assets or liabilities contain a significant unrecognized gain or loss, it might have a significant impact on the company’s future sustainability. The income statement is a financial statement that investors look at before deciding whether or not to invest in a firm. The earnings per share, or net earnings, and how it’s allocated across the shares outstanding are shown in the financial accounts.

Disadvantages of Statement of Comprehensive Income

You’ve now constructed an accurate income statement using all of the information you’ve gathered. This will offer you a better grasp of income statement definition in the future, which will help you and your organization. On your income statement, deduct the whole cost of goods sold from the total income.

This allocation Medical Billing Process process can be cumbersome and will require more time, effort, and professional judgement. The amount of net income will cause an increase in the stockholders’ equity account Retained Earnings, while a loss will cause a decrease. To compute income tax, multiply your pre-tax income by the appropriate state tax rate. Lottery wins are included in their taxed or comprehensive income, although they are not considered normal earned income. This is due to the fact that their lottery wins have nothing to do with their employment or occupation, but they must still be accounted for. A standard CI statement is usually attached to the bottom of the income statement and includes a separate heading.

- If the corporation’s shares of stock are publicly traded, they will also read the additional information presented in the corporation’s Annual Report to the Securities and Exchange Commission, Form 10-K.

- Cost of goods sold is usually the largest expense on the income statement of a company selling products or goods.

- Vyapar employs robust data storage measures to safeguard your financial information.

- Conversely, a company with modest net income but positive OCI may be undervalued if those items are expected to crystallize favorably in the future.

- As we see above, the Income Statement contains the revenues and expenditures related to the business’s main operations.

Accounting

Marketable securities include investments in common stock, preferred stock, corporate bonds, or government bonds that can be readily sold on a stock or bond exchange. These investments are reported as a current asset if the investor’s intention is to sell the securities within one year. Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, contra asset account even if cash is not received at the time of delivery. Journal entries usually dated the last day of the accounting period to bring the balance sheet and income statement up to date on the accrual basis of accounting. In addition to the annual consolidated financial statements, the publicly-held corporation will issue quarterly consolidated financial statements.

Recent Comments